ESG Due Diligence

Get in touch

We work with our clients to provide ESG Due Diligence to maximise returns and minimise risk. Working with private equity and corporations to integrate ESG and Sustainability to assess your investment sustainability and enhance your responsible investment and stewardship approach.

An Environmental, Social and Governance Due Diligence (DD) investigates the value implications of ESG topics and highlights ESG risks/opportunities.

Maximising your investment returns, helping to navigate your M&A strategy, and creating sustainable finance products to facilitate responsible investments, prioritising material environmental and social responsibility.

Why undertake a pre-sale ESG Due Diligence process?

Undertaking a pre-sale ESG Due Diligence will assure prospective investors that you have the correct procedures in place. These include carbon footprint reduction, Scope 3 emissions reporting, supply chain sustainability and human rights due diligence.

It also looks at whether any current actions are correctly communicated, avoiding potential any liabilities under greenwashing regulations and addressing any environmental impacts your business might have, while recognising the social impact of your actions and the governance strategies in place.

Risk Valuation

Legal, Compliance and Disclosures

Investor Confidence

Reputation and Cost Reduction

Premium Valuation

Enhancing your due diligence, ESG reporting and sustainable investment strategy

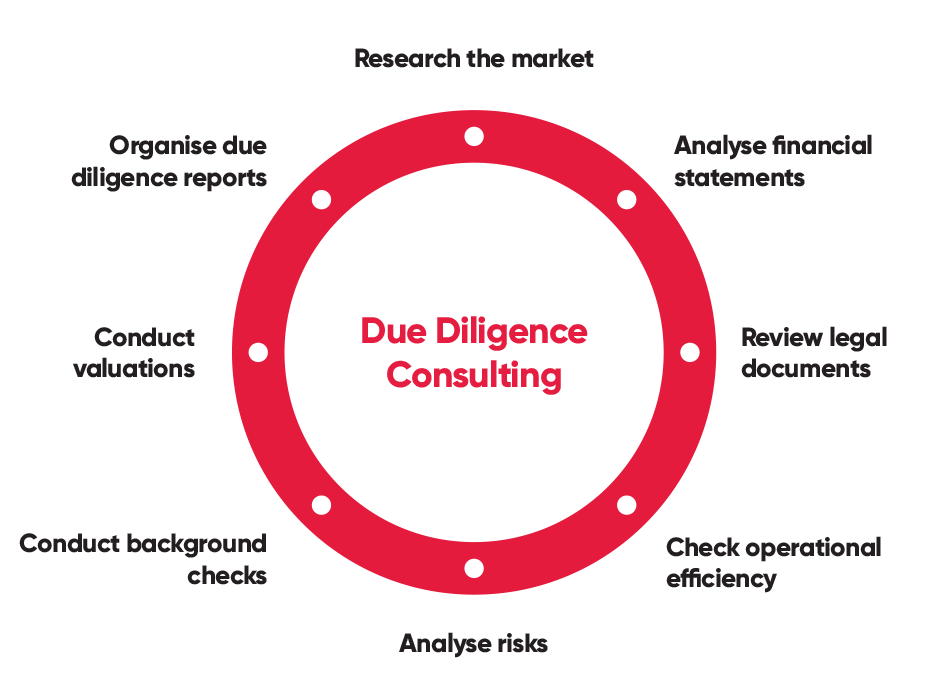

How Oury Clark can help you with ESG Due Diligence

We have a deep domain expertise in ESG, Finance, Legal and Accounting as a one-stop shop.

We work collaboratively with our clients to provide strategic and commercial advice.

Our ESG Due Diligence adds value as you prepare for exit, during the deal and post deal, assessing key factors such as climate resilience.

We tailor our approach to understand how financial performance is potentially impacted by sustainability – revenue (future cash flows), costs, assets and liabilities. We use a three-lens approach of risk management, value-creation and sector-specific risk assessment. We look at how the company is strategically positioned in the market and use this to benchmark the companies ESG position, then undertake a risk and opportunity assessment of the organisation to determine and prioritise levers that drive EBITDA multiples.

Pre-Deal Assessment

Buy-Side Due Diligence

- Assess material ESG factors on business model

- Market landscape and benchmarking

- Company-specific ESG activities assessed

- Identify value-creation levers

- Identify risks and impact on EBITDA

- Action plan post-investment – 100 days, 1 year

Vendor Due Diligence

- Agree ESG assessment framework

- Highlight key material ESG factors on business linked to EBITDA producing a Red-flag report

- Provide quick-wins support and prepare management for ESG questions

- Produce ESG strategic report and roadmap

Post Deal

ESG 100-day action plan and roadmap

- Critical ESG actions to realise value and de-risk investment

- Workshop to define key ESG objectives and framework

- Roadmap aligned to business strategy and investment milestones to ensure holistic plan

Governance and compliance-led

- ESG reporting and disclosure support complies with investor requirements

- ESG regulation and compliance, e.g. CSRD, TCFD, IFRS S1&S2, etc.

Exit-Readiness

Identify risks and opportunities

- Critical ESG actions to realise value and de-risk investment

- Workshop to define key ESG objectives and framework

- Roadmap aligned to business strategy and investment milestones to ensure holistic plan

Governance and compliance-led

- ESG reporting and disclosure support complies with investor requirements

- ESG regulation and compliance, e.g. CSRD, TCFD, IFRS S1&S2, etc.

Key Contacts

Related Resources

GHG Emissions Reporting

Greenwashing

External Assurance & Sustainability Reporting

ESG Materiality

ESG for SMEs

Let us Introduce Ourselves

To find your nearest office or get in touch with one of our specialist advisors to see how we can help your business, please go to our contact page.