| Client challenge | Solution | Output | Outcome |

|---|---|---|---|

| Client challenge Regulatory / supplier requirements for ESG data | Solution Measure and report – develop robust metrics | Output Regulatory compliance – avoiding fines and reputational damage – and satisfying supplier requirements | Outcome Compliance-led |

| Client challenge Identify where and which ESG actions can create value | Solution Conduct a trade-off exercise e.g.: holistic cost-benefit analysis (scenario) to understand options | Output Use scenario Accelerate achieving business strategic objectives | Outcome Long-term value-creation and de-risking |

| Client challenge Effectively integrating sustainability into core strategy | Solution ESG programme embedded into Governance Risk Compliance (GRC), board and organisation | Output Increase investor confidence and helps future-proof strategy | Outcome Accelerating short-term impact |

| Client challenge Balancing short-term costs with long-term gains | Solution Material ESG data collected, processes, systems and controls implemented (ERM), then data used for emergent strategies | Output Directed investments leading to operational efficiencies and enhancing business opportunities | Outcome Embedding your ESG across your business (assurance-led) |

| Client challenge Managing risks and engaging with shareholders | Solution Stakeholder survey to understand where sustainability can drive value | Output Enhanced reputation with value derived from the constituent parts of ESG | Outcome ESG Good Governance |

Sustainability Health Check

Get in touch

Our Sustainability health check will evaluate your current ESG practices and identify gaps or areas for improvement.

We work with you to define what is material to your organisation so that it aligns with your strategy, commercial drivers and stakeholders. This is aligned with industry best practice such as Sustainability Accounting Standards Board (SASB) materiality.

What Is It?

A Sustainability Health Check provides insight into your current management of ESG risks and opportunities and helps to identify areas for improvement and guide future strategies. The analysis will focus on:

Environmental

- Energy usage

- Waste management

- Carbon footprint

- Resource management

Social

- Employment practices – WFH practices, maternity, recruitment and retention

- Diversity, Equity & Inclusion (DE&I) – recruitment

- Health & Safety

- Community engagement

Governance

- Corporate governance – the structure and effectiveness of the Board and managements

- Ethical practice – anti-corruption, Modern Slavery, Anti-money-laundering

- Transparency and reporting – the quality and transparency of ESG reporting

- Risk Management – policies and procedures for identifying risk

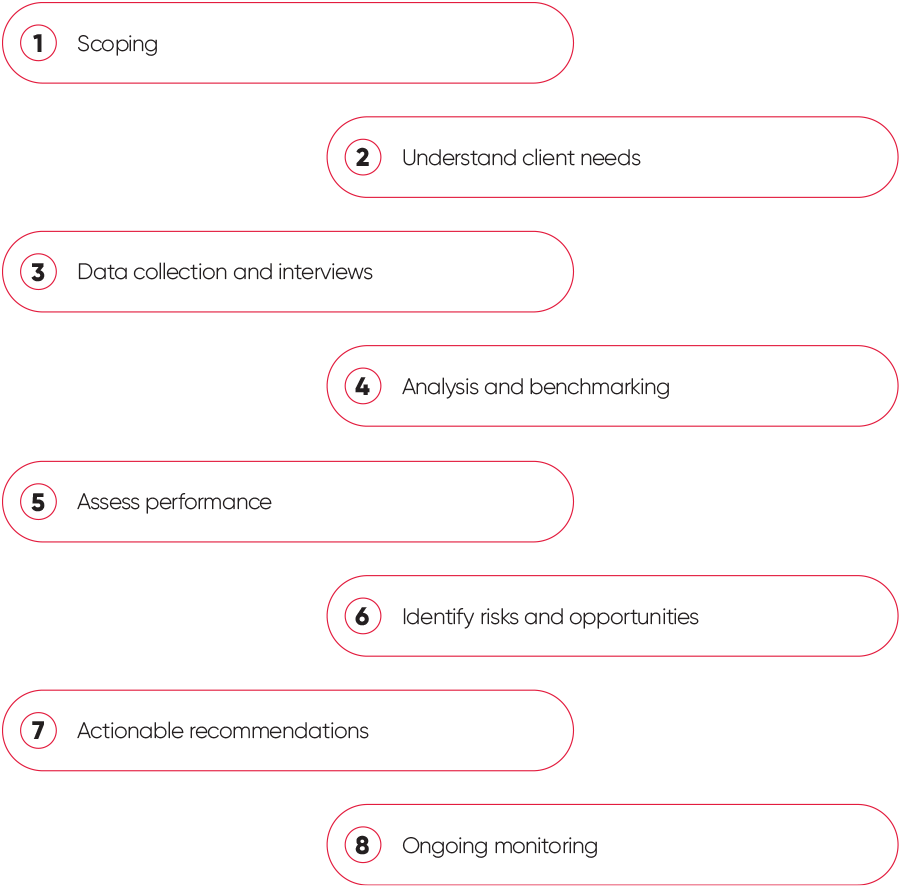

Our Approach – De-risking ESG Through Our Data-Led Approach

Compliance-led, yet holistic, our approach encompasses risk, information and security (for CISOs), assurance with governance to ensure the right information is reported reliably and aims to inform decision-making at senior and board level. We integrate ESG data and processes to help break down silos and align systems and workflows.

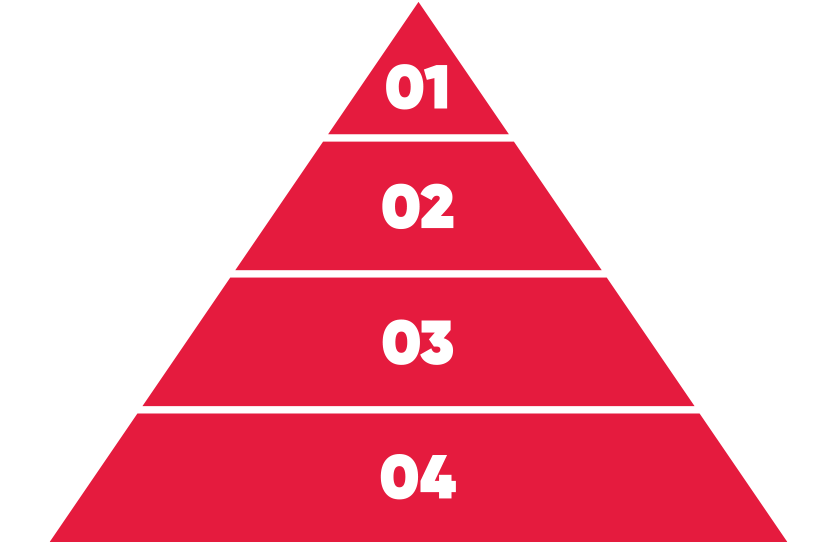

1. De-risk

Lines of defence, responsibilities. Adequate systems, processes and controls to actively de-risk and create strategic opportunities

2. Information & Security (CISO)

ISO 27001, ISO 9001, reporting lines, Security Operations Centre, NIST, etc.

3. ESG Assurance Readiness

COSO 17 principles – Control Environment, Risk assessment, control activities, information and communication, monitoring activities

4. ESG Governance & Compliance

RACI of personnel, adequate skills and compliance, correct disclosures and information

Plan

Baseline assessment of current process, control, systems, governance and information & security. Set the objectives and develop a plan.

Evaluate & Document

Assess maturity of organisations internal controls program and relevant documentation, e.g. formal ERM, policies, etc.

Remediation

Any gaps identified by these for ESG, an implementation plan is developed for remediation – steps, timeline, responsibilities.

Testing & Reporting

Continuous testing and reporting to ensure compliance and all ESG information is fully integrated into the organisations decision-making and assurance.

Inputs and Outputs

Although each health check is bespoke, certain elements are consistent, including gathering data through a stakeholder survey and market landscape exercise, and then determining materiality to inform where investment should flow, and how multiple demands should be prioritised

What to Spend and Where?

Review of ESG topics to financial performance – balancing the trade-offs

ESG Health-Check Assessment on Topic 1

Detailed recommendation addressing:

- Problem statement

- Benefits to client

- Scope of recommendations incl.

- Timeline

- costs to client

- capabilities required

ESG Prioritisation

Through an interactive workshop we work with senior managers to determine prioritisation of focus topics

ESG Health-Check Assessment on Topic 2

Detailed recommendation addressing:

- Problem statement

- Benefits to client

- Scope of recommendations incl.

- Timeline

- costs to client

- capabilities required

The Deliverable – ESG (Internal) Report

Scope and Contents

Sustainability health check report: A detailed document summarising the findings, including data analysis. Within the Report will be:

- Benchmarking: a comparison of the client’s ESG performance against industry peers and best practices

- Risk Assessment: analysis of ESG-related risks and potential impacts on the business

- Stakeholder Feedback: insights from stakeholder interviews and surveys

- Action Plan: outlining specific actions to improve ESG performance, with timelines and responsible parties

The Report may suggest other actions, such as a GHG Accounting and Net Zero exercise, including creating an emissions reduction glidepath which can create value and reduce costs.

Scope of Action Plan

Detailed recommendation addressing:

- Project Title: Green customer strategy

- Problem statement: Acquiring customers with sustainability consumer patterns

- Alignment with business strategic objective: International expansion

- Benefits to client: financial and non-financial (revenue growth, diversification of turnover, enhanced reputation, etc.)

- Project KPIs: cost, # green customers, # green products …

- Scope of recommendations include:

- Timeline and milestones

- Assumptions (if any)

- RACI

- Benefit-Cost Analysis

- Capabilities required – people, processes and systems

- Communication strategy

- Monitor, track progress and report with lessons learnt

- Project Governance if needed for reporting

Key Contacts

Related Resources

Let us Introduce Ourselves

To find your nearest office or get in touch with one of our specialist advisors to see how we can help your business, please go to our contact page.