ESG for SMEs

Small and medium-sized enterprises (SMEs) are increasingly required to disclose their ESG performance due to growing stakeholder demand.

This demand primarily originates from larger companies, which are mandated by regulations and institutional investors to obtain such information from their suppliers. Additionally, potential lenders are seeking ESG data to assess new risks and opportunities as climate change impacts physical assets and business strategies.

SMEs must not ignore this trend, especially given the potential for future regulations targeting smaller businesses. Compliance with ESG requirements extends beyond legal obligations, however. There are broader benefits of ESG data to SMEs including enhanced business value and strategic insights.

What are the benefits of focusing on ESG in your business?

- To save money – the efficiencies which come from using less reduces costs and insurance premiums and environmental impact

- Larger companies expect their suppliers to act – SMEs need to engage in this process to avoid missing future contracts and growth opportunities. Being able

to respond to this demand will give your company a competitive advantage - Access to finance – By reporting on ESG, SMEs showcase resilience, innovation, and risk management capabilities, making them more attractive to lenders

and investors - Risk mitigation and opportunities – the former include climate change, resource scarcity and regulatory change, while the latter might be increasing margins by focussing on higher-margin sectors

- Resilience – Integrating sustainability early ensures long-term resilience and adaptability as the business evolves (future-proofing)

- Ease of compliance / transparent reporting – including surveys sent by larger companies which are required to report and so need information from their supply chain – this is ‘trickle down’ compliance – intentional by regulators

- To re-invigorate and strengthen corporate strategy.

- To attract and retain the best employees and management – businesses with purpose have a lower turnover of staff as they provide more than ‘just’ a salary

- Diverse workforce – part of the ‘S’ – promoting diversity and inclusion fosters innovation and employee satisfaction

- Competitive edge – clearly outlined goals aligned with changing consumer preferences will provide this along with operational efficiencies leading to revenue growth

- Business reputation – with consumers, customers, stakeholders including employees and investors

- Community engagement – builds goodwill and strengthens local ties

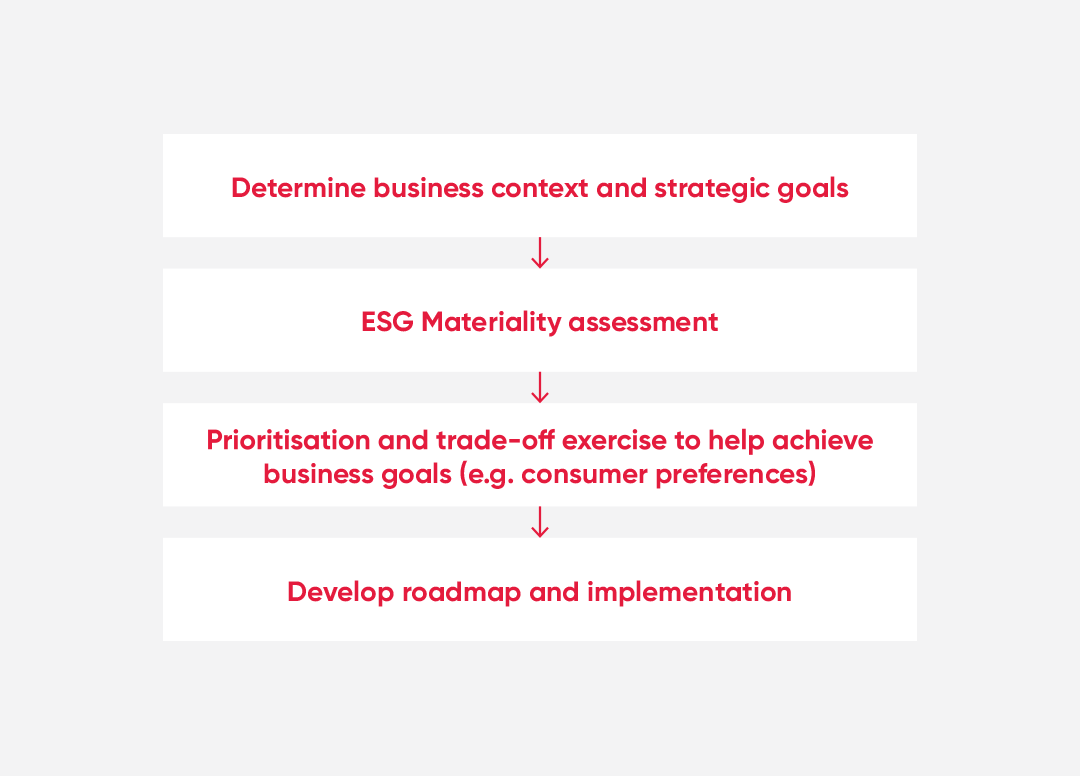

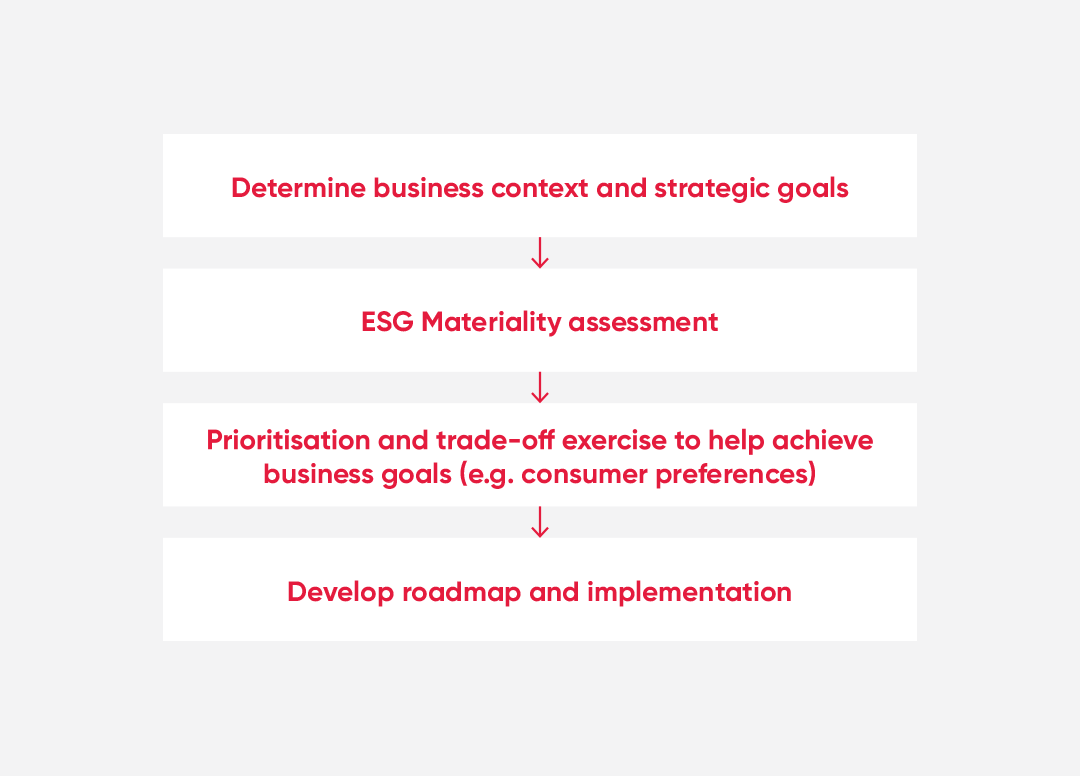

Action plan

Depending on the organisation, your first step is to understand what data you have, and what data you need. Your leadership team needs to provide a clear strategic direction for the process which will include awareness building and engagement throughout your organisation.

Conducting a materiality assessment can provide valuable insights into risk management and opportunities, potentially shifting your strategic focus – see our Quick Guide on Materiality.

This process must be led from the top and will involve changes to ensure all relevant departments have a voice and responsibility in the new strategy. Expect trade-offs between short-term operational issues and a long-term strategic vision, as the assessment will refresh your risk perspective.

You will need to appoint at least one individual, or ideally a cross-functional team, to be accountable for ESG targets and ensure they have the necessary resources. Your supply chain and value chain are crucial; consider your suppliers and all stakeholders as strategic partners. Balancing conflicting demands requires senior management support to drive sustainability throughout the business.

You should set targets that align with your business values and priorities, and monitor and collect relevant ESG data, such as carbon emissions, waste reduction, and diversity metrics. Refer to our Quick Guide on Green House Gas Emissions Reporting for more details. Finally, report and communicate your efforts effectively.