Corporation Tax

For companies that wish to purchase rather than lease their cars, the purchase of new, unused cars with zero CO2 emissions are eligible for 100% first year capital allowances. This means you can deduct the full cost from your pre-tax profits.

The purchase of new or second hand cars with CO2 emissions from 1-50g/km will be added to the main pool for capital allowances with an annual writing down allowance of 18%. Fully electric, second hand cars will also be eligible for the 18% writing down allowance rate.

The purchase of new or second hand cars with CO2 emission exceeding 50g/km must be allocated to the special rate pool, receiving annual writing down allowances at 6%.

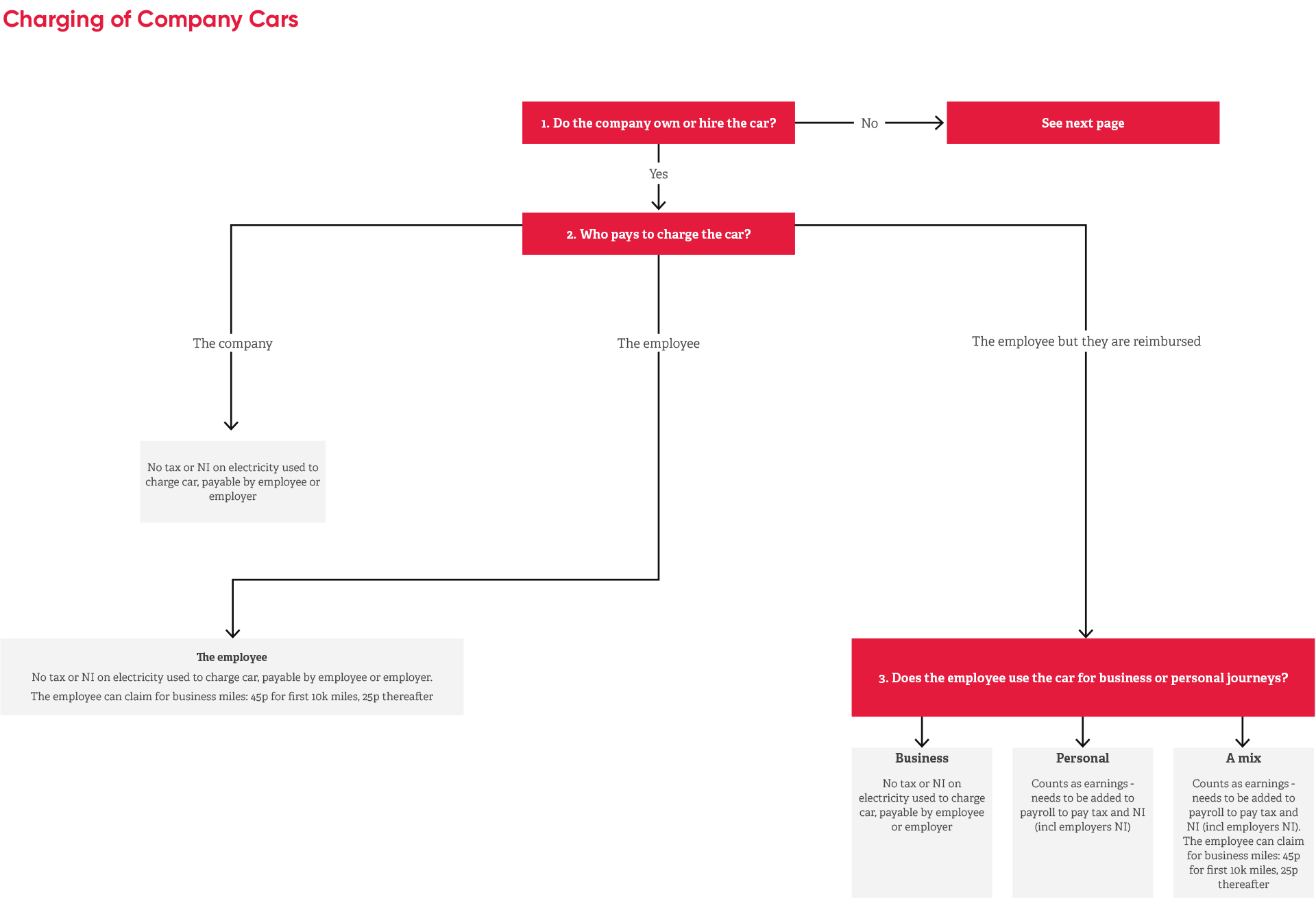

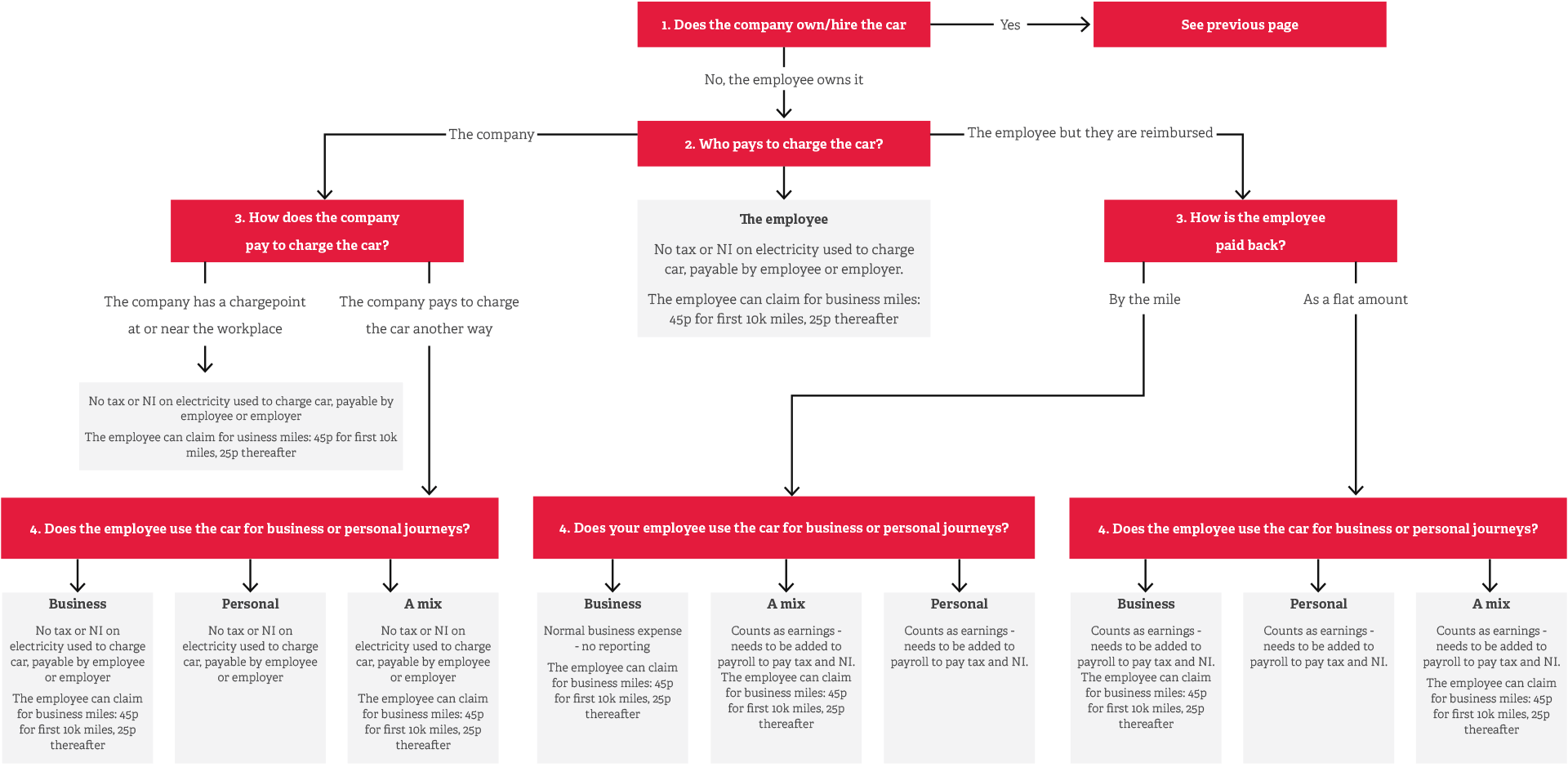

The fitting of a qualifying electric charging point for cars which must be used in the business can benefit from the 100% first year allowance.

VAT

VAT on a new car can be claimed if it is used only for business. The car must not be available for private use, and you must be able to show that it is not, for example it is specified in your employee’s contract.

Salary Sacrifice

What are the benefits of a salary sacrifice scheme for an employee?

Salary sacrifice is where your employee agrees to give up part of their pre-tax salary in exchange for a benefit from their employer. A salary sacrifice scheme will allow the employee to drive a fully electric company car, by forgoing a portion of their gross salary. The amount will be deducted before tax and National Insurance contributions are applied which in turn reduces their taxable gross pay. Note, the optional remuneration rules do not apply to low emission vehicles with CO2 emmisions of 75g/km or less.

What are the benefits of a salary sacrifice scheme for an employer?

A salary sacrifice scheme will allow the employers to offer employees a new car at a lower cost with a tax-efficient payment method. Additionally, the company should also benefit from reduced National Insurance contribution payments.

Overall Benefits

For the Employer:

Deduction from pre-tax profits for the cost of the Car if owned by the business, Increased employee engagement and retention, National Insurance contribution savings (if administered through salary sacrifice), Reduced fuel costs (compared to petrol and diesel cars), No initial upfront costs – if the car is leased, Employee interaction and engagement is covered by the leasing company.

Benefits for the Employee:

Access to a brand-new electric car, Significant income tax and National Insurance savings No initial upfront costs, Flexible mileage and terms, Fixed cost motoring without unexpected bills or service costs.