Deciding how best to plan your finances can be daunting. With so many options available and so many uncertainties, how do you choose what’s right for you?

Slough Office: Herschel House,

58 Herschel Street, Slough SL1 1PG

London Office: 10 John Street,

London WC1N 2EB

Slough Office: Herschel House,

58 Herschel Street, Slough SL1 1PG

London Office: 10 John Street,

London WC1N 2EB

Deciding how best to plan your finances can be daunting. With so many options available and so many uncertainties, how do you choose what’s right for you?

Our job is to eliminate as much of that uncertainly as possible and to work with you to identify the most appropriate way for you to achieve your financial goals.

By working through a series of logical steps, we will help you gain a better understanding of the options available, and working together, we can devise and implement a suitable financial plan to target your goals.

We have the expertise to give you the advice that you need to make smart choices for the future.

Get in touch and see what we can do for you.

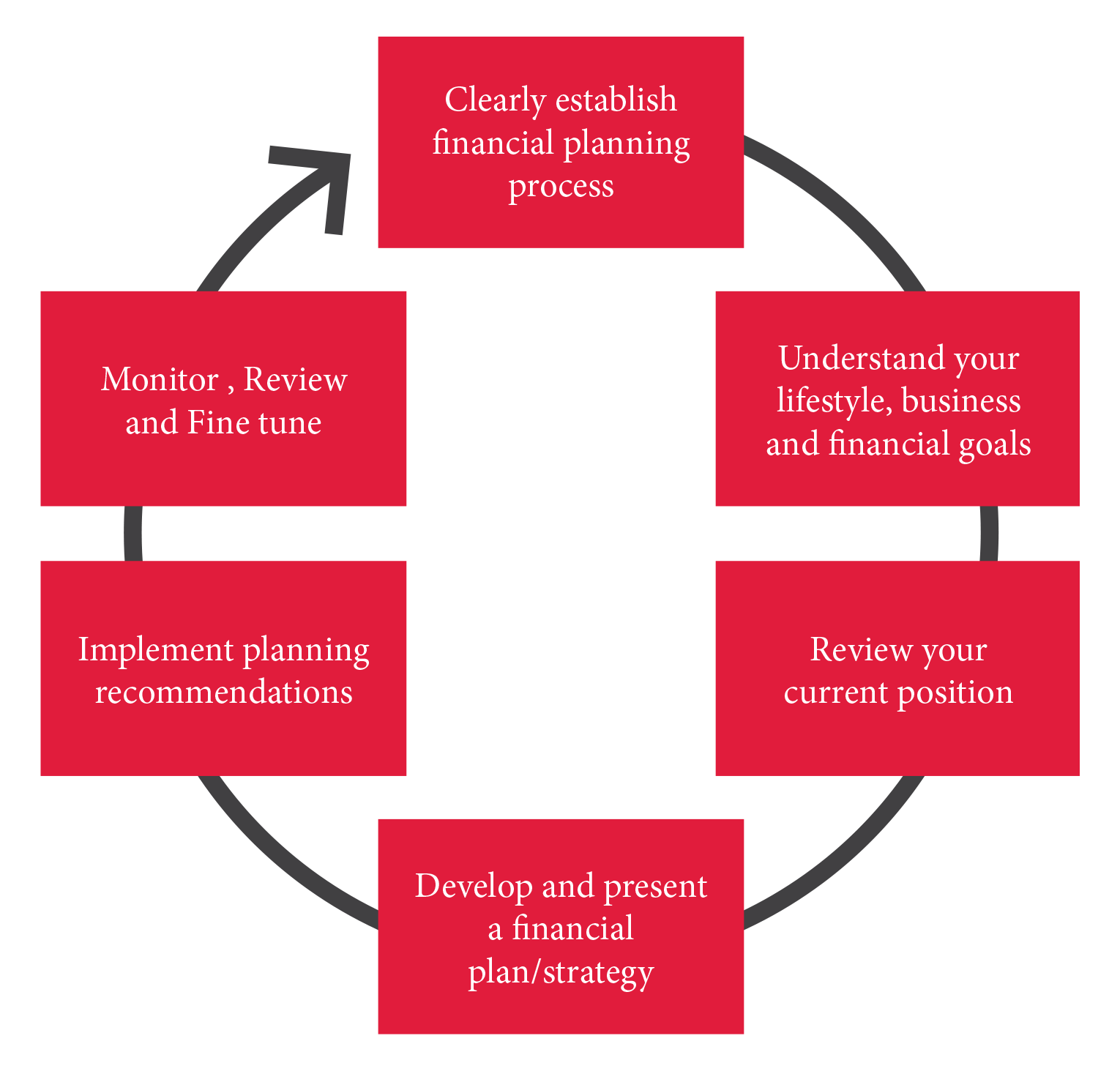

The personal Financial Planning process consists of the following six steps:

We can also offer you a free review of your financial planning with one of our qualified advisers, please email financialplanning@ouryclark.com

The information given in this document is for information only and does not constitute investment, legal, accounting or tax advice, or representation that any investment or service is suitable or appropriate to your individual circumstances. You should seek professional advice before making any investment decision. The value of investments, and the income from them, can fall as well as rise. An investor may not get back the amount of money invested.

Past performance is not a guide to future performance. The facts and opinions expressed are those of the author of the document as of the date of writing and are liable to change without notice. We do not make any representation as to the accuracy or completeness of the material and do not accept liability for any loss arising from the use hereof. We are under no obligation to ensure that updates to the document are brought to the attention of any recipient of this material.

Oury Clark Oury Clark is authorised and regulated by the Financial Conduct Authority

To find your nearest office or get in touch with one of our specialist advisors to see how we can help your business, please go to our contact page.