Determining what is material to an organisation is the first step towards ESG reporting.

ESG Materiality

In the context of Environmental, Social, and Governance (ESG), materiality refers to the importance of an issue to both your business and its stakeholders. Determining ESG materiality is crucial for making strategic business decisions, as it helps identify which actions to prioritise and which to avoid.

This process can provide insights into competitive advantages and guide strategic direction.

Do you need help with ESG Materiality?

We have the expertise to give you the advice that you need to make smart choices for the future.

Get in touch and see what we can do for you.

The term, materiality, comes from financial reporting. In this context it refers to determining whether information could influence investor’s decisions.1 If it could, then it is material. This means that materiality “applies not only to the presentation and disclosure of information, but also to decisions about recognition and measurement”. 2

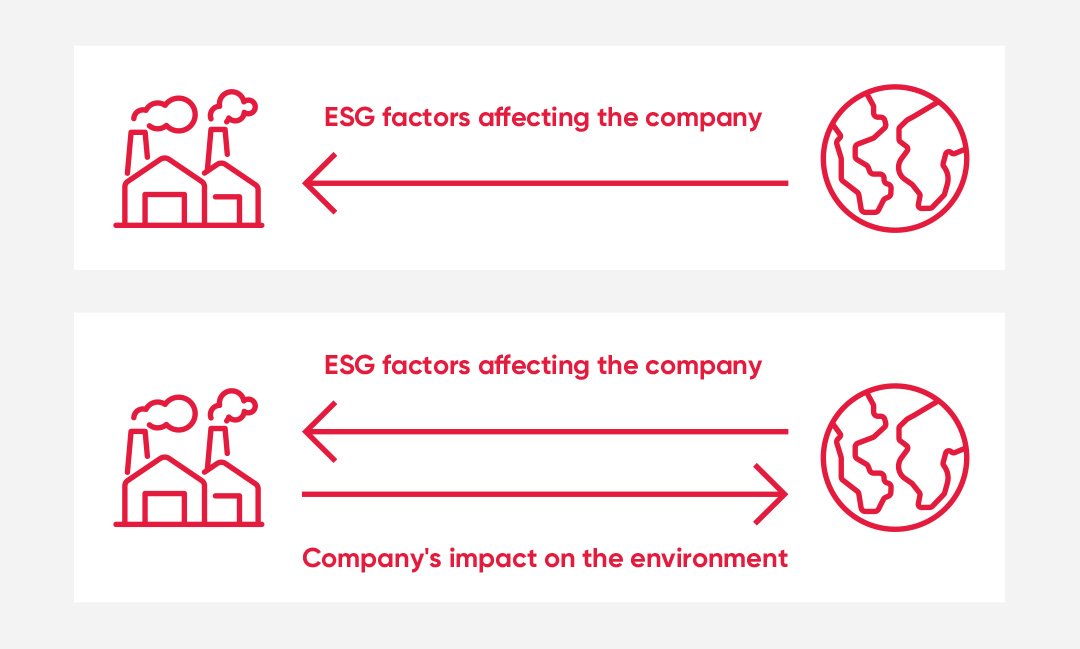

In sustainability, the concept of ‘Double Materiality’ is key. It encompasses both financial materiality (outside-in perspective) and impact materiality (inside-out perspective). The inside-out perspective considers the actual or potential short, medium, and long-term impacts on people or the environment directly linked to your company’s operations and value chain.

The European Union’s Corporate Sustainability Reporting Directive (CSRD) mandates the concept of double materiality for companies reporting sustainability information. It only applies to the largest entities at present.

A large entity is defined as one with a net turnover exceeding €40 million, assets exceeding €20 million and more than 250 employees. Companies meeting at least two of these criteria will have to company with the CRSD.

A materiality assessment process will help identify the material impacts, risks and opportunities (IROs) as well as the respective material information to disclose. IROs will need to be for both the company’s own operations and the value chain in the short, medium and long term.

Relevance vs material

It is important to understand the difference between relevant issues and material issues. The list of relevant issues to your business may be long, but most of these are not material. If you try and prioritise everything, you have prioritised nothing and distracted your team from strategic aims .

To determine what is material, a materiality assessment is necessary.

What is a materiality assessment?

A materiality assessment is the process where you identify relevant issues, determine which of these are material and then embed them into your strategy including you core business decisions and processes.

There are a number of steps to a materiality assessment:

1. Identify relevant issues

Contextualise the materiality exercise within your business framework. Start by using the sectoral taxonomies of the Sustainability Accounting Standards Board (SASB). Depending on your organisation’s size, you should then establish a steering committee with a cross-functional team responsible for developing and executing the ESG strategy. At this stage, refine and identify relevant ESG topics to assess potential and actual impacts, risks, and opportunities. Link these to your risk register to ensure it includes sustainability-related issues. Remember, consider both the external impacts on your business and your business’s impact on the world.

2. Consult stakeholders

Typically, these will be customers, employees, partners, associates, clients, critical suppliers and your local community. Using a stakeholder mapping exercise, engage with stakeholder groups through surveys and focus groups to attain insights of positive and negative impacts using qualitative and quantitative data. Present your list of relevant issues to gather information on their differing perspectives – helping you to identify the ESG / sustainability issues most important to them.

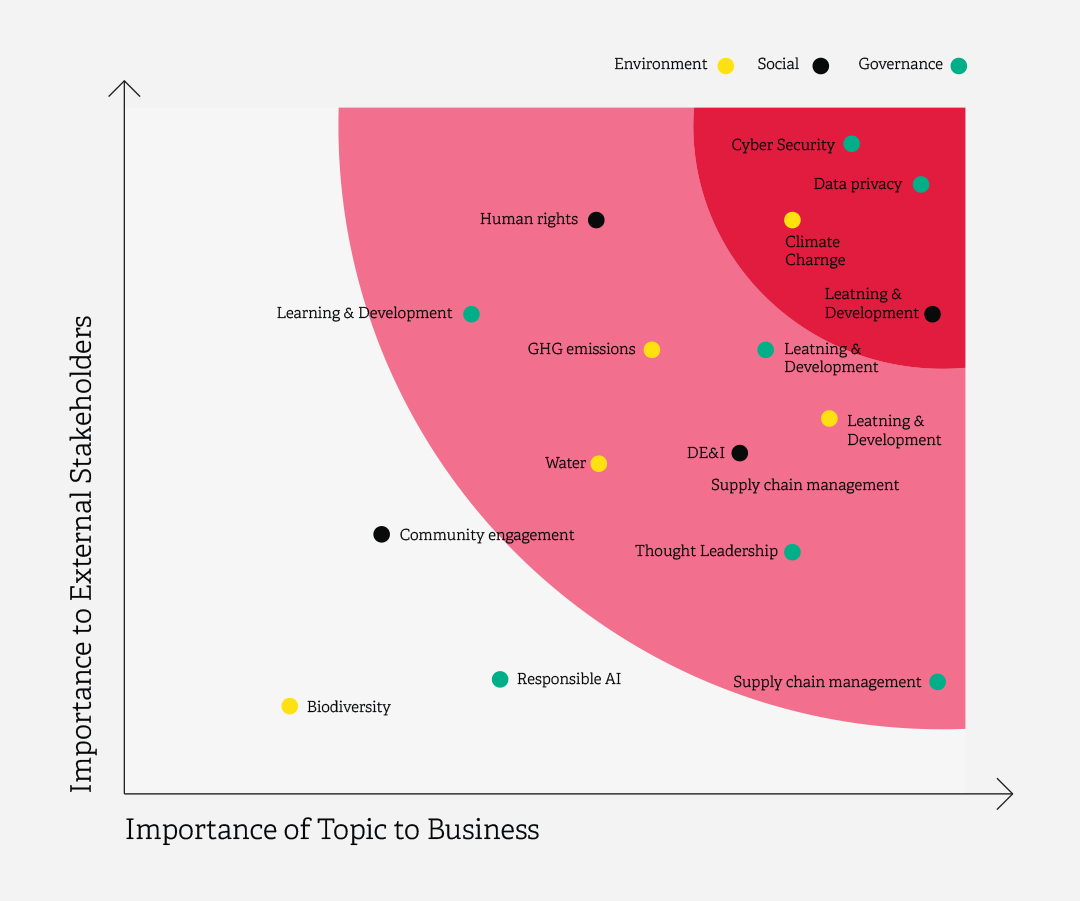

3. Compile a list of material issues

From the complete list of ‘relevant’ issues you now need to determine materiality. There are various methods for ranking these issues including a further materiality survey of stakeholders, or, if you have enough information, a prioritisation matrix such as the below:

4. Analyse results and determine actions

Identify and prioritise critical issues, encompassing both risks and opportunities, to ensure a focused and effective strategy. Establish a clear hierarchy of actions to prevent strategic clutter and confusion. Continuously evaluate the material impacts, including financial materiality, risks, and opportunities related to sustainability. Consider factors such as time horizons, scale, scope, likelihood, and stakeholder input to guide your decisions.

5. Integrate the assessment results into your strategy

To achieve success, embed the identified ESG issues at the heart of your business strategy. This is crucial for risk mitigation, opportunity maximisation, and differentiation from competitors. Ensure senior management buy-in and clearly cascade strategic aims throughout the organisation. This approach will help align staff incentives, identify potential partnerships, and support your objectives. Use the assessment to inform decision-making, drive strategy, and, where appropriate, report and disclose your progress.

1 ’IFRS Practice Statement 2: Making Materiality Judgements

2 Audit & Assurance, Making Sense of Materiality, Hans Hoogervorst | September 25, 2017, IFAC

Related Quick Guides

Let us Introduce Ourselves

To find your nearest office or get in touch with one of our specialist advisors to see how we can help your business, please go to our contact page.