EORI Number

An EORI Number (Economic Operator Registration and Identification number) is required to import goods in or out of Europe. Any European country can issue one, and you only need a single number for the entire EU. Due to regulation changes an EORI number is now required to move goods between the UK and the EU. For shipments to Northern Ireland, an XI number is required.

Therefore, to sell to both the UK and Europe, you need:

- VAT registration in the UK

- VAT Registration in EU country of choice

- An EORI number in the UK

- An EORI number in the EU

- An EORI number to move goods into and out of Northern Ireland (XI number for N. Ireland)

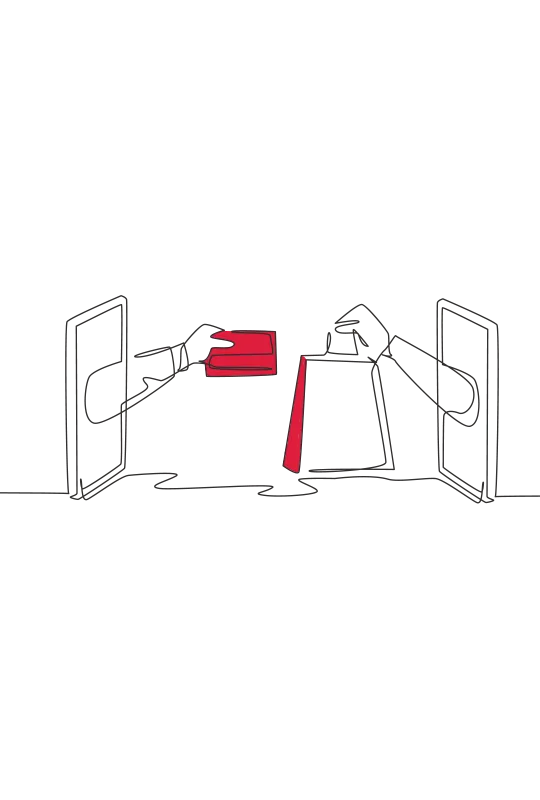

Duty

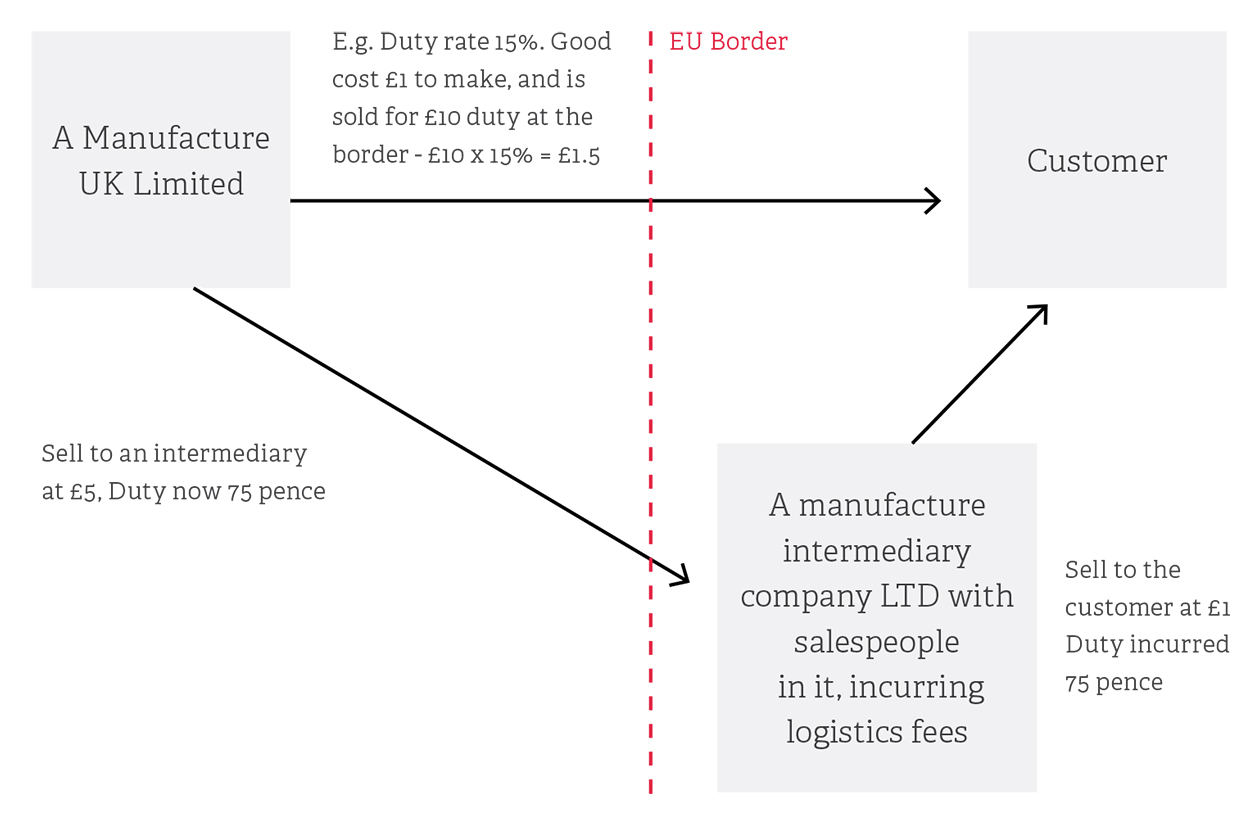

Any goods which cross a border will suffer Duty if there is Duty on the goods. However, low value consignments ( <£135 in the UK or €150 in the EU) are excluded. These Duty rates are standardised across Europe but are looked at and changed regularly. Goods shipped from the UK to N. Ireland are not subject to Duty if they are not considered at risk of being shipped on to Europe.

Duty is charged on the value at which the goods are being sold for as they cross the border. It is therefore important that the goods are valued correctly using the acceptable valuation methods, which are based on the World Trade Organisation (WTO)

Valuation Agreement

You must take care to ensure all tariff codes are correct and you understand the required rates for your goods and shipping method. Inspections may take place years after the relevant transaction has occurred and mistakes can be costly.

Duty can be reduced by using an intermediary which is performing an activity or adding value to the item.

Bonded Warehouses

A bonded warehouse is a place where goods physically enter the UK, but for Duty purposes do not technically enter. Any customs duty or VAT payments on items stored in the warehouse are deferred until the time that the goods are sold or removed.

Bonded Warehouses can be set up with HMRC approval and allow for the shipment of goods to other European countries “without entering the UK”. They are only recognised as entering the UK if they are shipped to the UK for a UK customer.