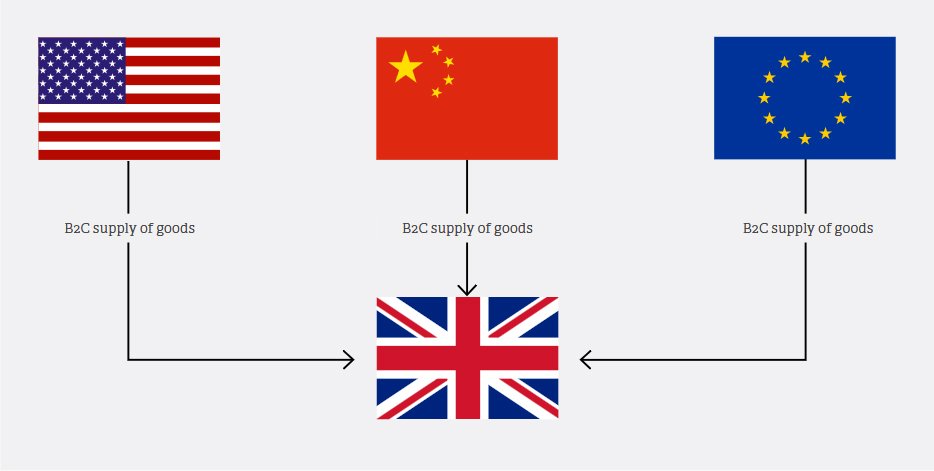

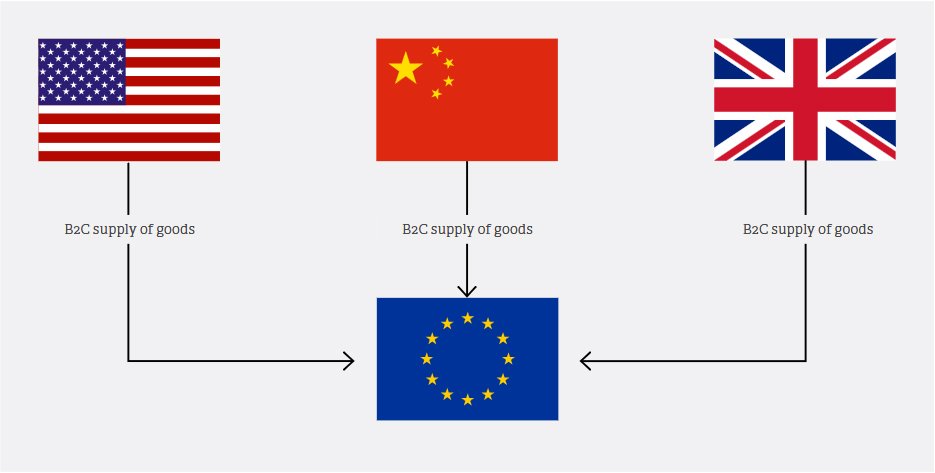

As a non-established UK or EU company, if you sell £1 or €1 of goods to any customer anywhere in Europe or the UK, you have an immediate duty to register for VAT in that country and charge VAT.

If you are not a UK-established entity or registered for VAT in the UK, you cannot sell any goods into the UK on a Business to Consumer (“B2C”) basis.

If you are not an EU-established Entity or registered for VAT in the EU, you cannot sell any goods into the EU on a B2C basis.

If you wish to sell B2C goods across Europe AND the UK, you need to register for VAT in the EU AND the UK.

In the EU, there are two schemes for reporting VAT on the sale of goods to consumers – the Union OSS and the Import OSS, and both schemes only require you to file one VAT return for all sales across Europe, rather than registering for VAT in each EU country you sell in.

There is no requirement to set up a company in the UK or the EU to sell goods, provided you don’t have employees or offices. A VAT registration is required and a foreign company can register for VAT in the UK and/or Europe, without physical presence.

In the UK, once you are registered for VAT you can import goods directly into the UK.

B2C sale of goods

*N.B. if you intend to hold stock in either the UK or the EU, then a VAT Registration in the relevant country must be obtained

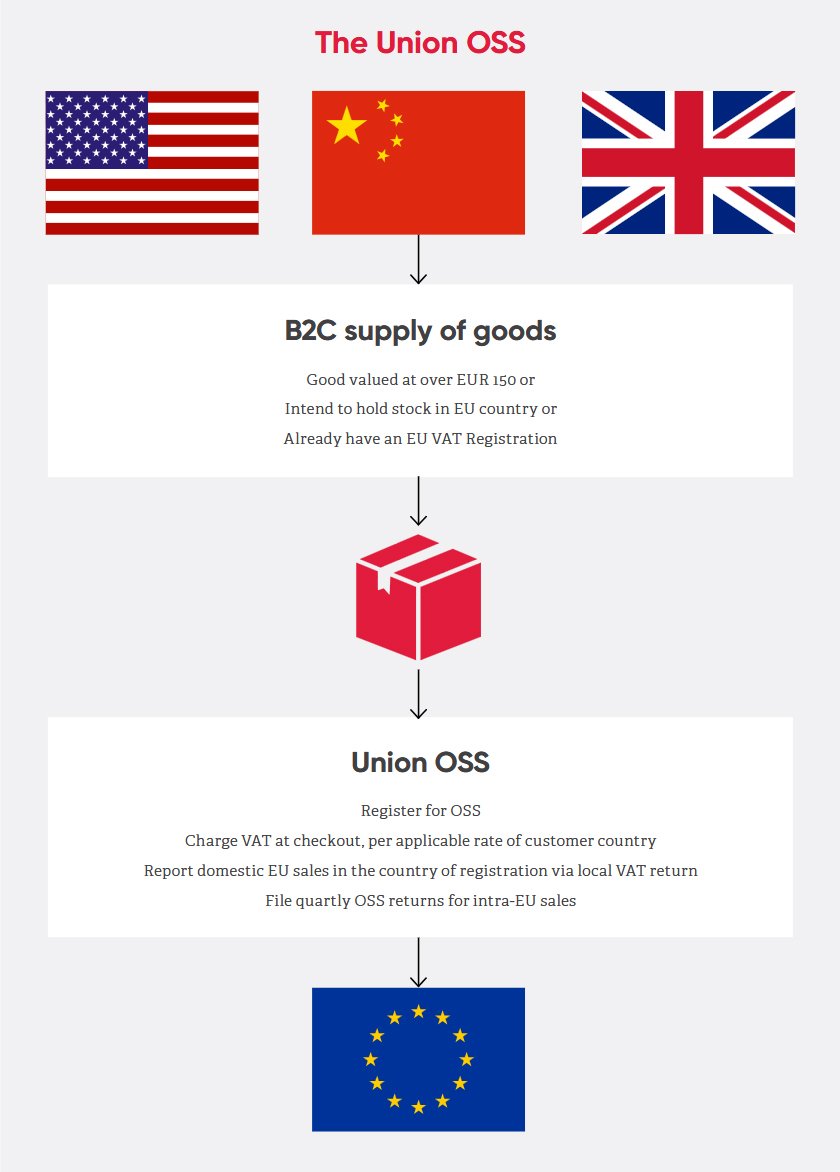

EU – The Union OSS

You need an EU VAT registration

- You need to have your stock in the EU country where you already have an EU VAT registration.

- You can then use this to register for a Union OSS to report B2C sales

- Domestic sales in the country of registration will continue to be reported in the local VAT registration.

- When the customer places an order on your webstore, you charge VAT at the checkout at the rate in the customer’s country.

- You ship the order from your stock in the EU, and it can be sent to customers based anywhere in Europe. There is no limit on the value of the goods you ship.

- The VAT you have collected at the checkout is then reported in a quarterly OSS return and paid to the Tax Authority via the OSS portal of the country you are registered in the union-OSS scheme.

- This reduces the administrative burden to companies as only one return in a single language is required for their EU-wide transactions.

- If you have multiple VAT registrations in the EU for B2C sales, then you can deregister your existing VAT Registrations and choose one OSS VAT Registration.

Example:

USACo makes sales of socks to Dutch, French, and German Customers. The socks (costing €45) are ordered online, to be delivered to the Customers.

USACo already has an EU VAT registration in the Netherlands where it holds stock. USACo register for Union OSS to account for VAT on the intra-EU sales to French and German Customers.

At the website checkout, the EU Customer completes the delivery information, and the VAT rate of the respective country to be paid by the EU customer is displayed and added to the cost of their order.

For sales to Dutch Customers, USACo files a local VAT return to the Dutch Tax Authorities and for French and German sales, a quarterly OSS return is filed via the Dutch OSS portal with the respective French and German VAT paid over, with all records kept for 10 years.

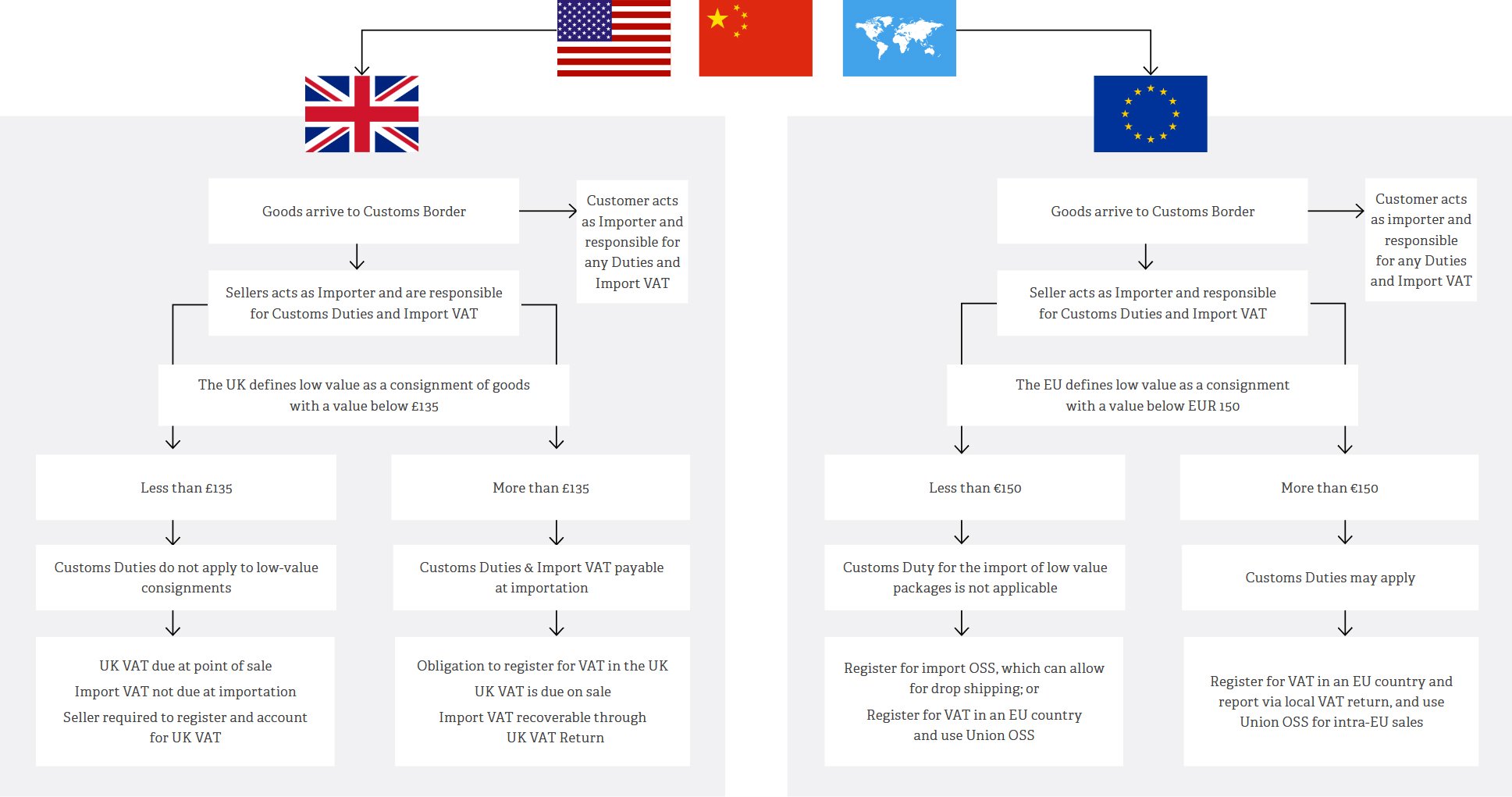

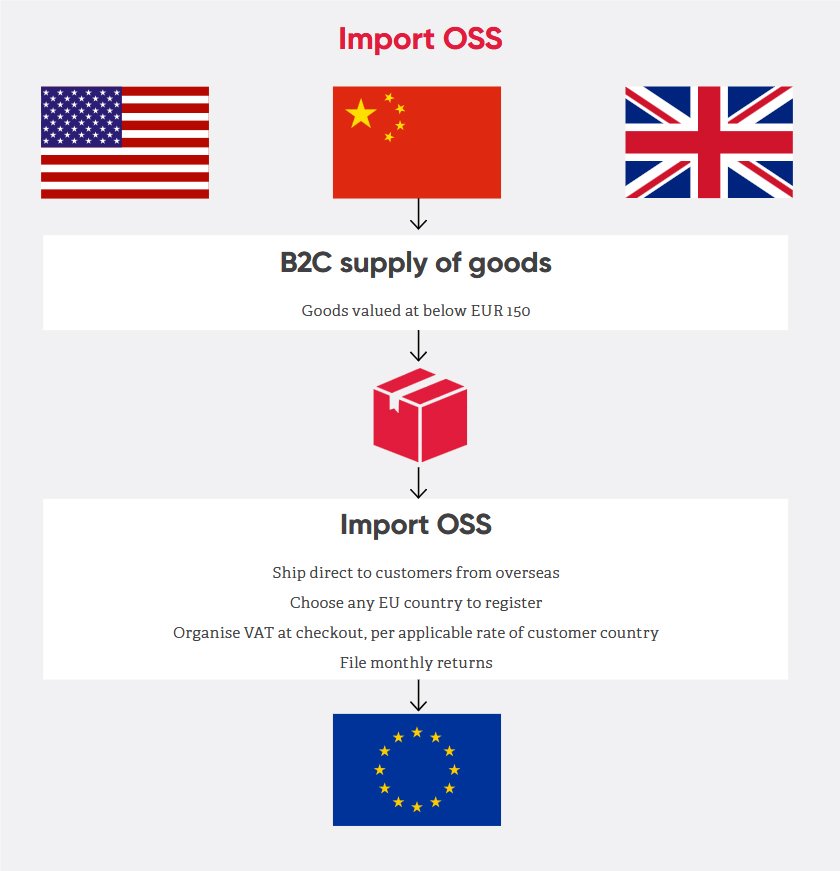

EU – the Import One Stop Shop (IOSS)

- If the sales value of B2C goods is below €150 you can consider registering for an “Import OSS”

- Stock does not need to be held in the EU and can be “drop shipped” or shipped direct from overseas to the customer anywhere in Europe.

- Nominate any EU country to register for IOSS. If not an EU-established company, appoint an intermediary (an accountancy firm can do this for you generally) to file and pay on your behalf to the Tax Authority.

- You’ll get a unique IOSS identification number to put on all packages for EU consumers. The IOSS number indicates to Customs that VAT is being properly declared to ensure faster customs clearance.

- You do not pay VAT when importing the goods, and the goods go directly to the customer.

- Charge VAT at the checkout at the rate that applies in the customer’s country and report the VAT by filing monthly returns via the IOSS portal and pay over any VAT collected from the customer via the portal. The portal allocates the VAT to the relevant Tax Authority

- You can be a member of the Union OSS AND the Import OSS schemes. Both schemes require you to keep complete separate sales records for 10 years.

Example:

ChinaCo makes sales of hats to Spanish, Italian, and Dutch Customers via their online shop. The hats (costing €55) are ordered online, to be delivered to the Customers. No stock is held in the EU – the goods are made to order in China and then shipped to EU customers.

ChinaCo register for IOSS in the Netherlands and appoints an intermediary – the intermediary is jointly and severally liable for the payment of VAT to the relevant tax authority. In practice, the intermediary will submit the IOSS returns. ChinaCo receives an IOSS number which is provided to the customs authorities in the customs declaration to release the goods for free circulation in the EU – i.e., the goods go through Customs to the customers and no additional import charges are made to the customer.

When the customers buy the hats from the website at the website checkout, the EU Customer completes the delivery information, where the VAT rate to be paid (the VAT rate of the customer country, presuming this is where the goods are sent) is displayed and added to the cost of their order.

ChinaCo uses IOSS to import goods into Spain, Italy, and the Netherlands with one IOSS Number.

ChinaCo then works with the intermediary to prepare and submit a monthly IOSS return to the Dutch Tax Authorities via the IOSS portal for all the eligible supplies, with all records kept for 10 years.

UK – B2C E-Commerce

- If you are not a UK-established entity or registered for VAT in the UK, you cannot sell any goods into the UK on a B2C basis.

- A UK VAT registration is required

- For low value goods, defined as consignments of goods with a value of less than £135, there are no customs duties. Goods can be drop shipped to the UK with import VAT recovered via the UK VAT return. Once imported, the goods are in the UK at the time of sale and the B2C sale is subject to UK VAT

- For high value goods, defined as consignments of goods with a value of more than £135, there may be applicable customs duties. Goods can be drop shipped to the UK with import VAT recovered via the UK VAT return. Once imported, the goods are in the UK at the time of sale and the B2C sale is subject to UK VAT.

- Where goods are outside the UK at the point of sale, and the goods will be dispatched to a UK customer, with a value of less than £135, then UK VAT is due at the point of sale (for example, at the checkout at the website).

Import VAT is not due at the point of import duty (customs duties on low value goods does not apply) and the seller is required to register and account for UK VAT.

Example:

NewZealandCo sell earrings to UK Customers via their website. NewZealandCo hold all stock in New Zealand and have no presence in the UK nor do they have a UK VAT registration. NewZealandCo cannot sell any earrings to UK customers without registering for VAT in the UK and the website must be set up to charge UK VAT for UK customers. Once NewZealandCo register for VAT in the UK, they can import goods into the UK for sale to UK customers. Where NewZealandCo are named as the importer of record, import VAT is recoverable via the UK VAT return. UK VAT is chargeable on the sale to the UK Customer. NewZealandCo would still be required to file nil returns over periods where there are no UK sales.