Companies that carry out ‘excluded activities’ are not allowed to offer EMIs. Excluded activities include:

The company (or at least one company in the group which must have a qualifying trade) has a permanent establishment in the UK

-

- banking

- farming

- property development

- provision of legal services

- ship building

Eligible employees

The company can decide which employees it grants EMI options to.

Employees however, have to meet the qualifying conditions. These include:

- being an employee of the company granting the options, or of a subsidiary company. For EMI purposes, directors are classed as employees of the company.

- working at least 25 hours a week for the company or group or, if less, 75% of their ‘working time’.

- not having a ‘material interest’ in the company or, if the company is the parent of a group, a material interest in any of the group companies.

- An individual has a material interest if their shareholding and Non-EMI options, together with those of their associates, exceeds 30% of the ordinary share capital of the company.

Requirements relating to options

To qualify for EMI, the options/shares must meet the following conditions:

- Shares must be non-redeemable fully paid-up ordinary shares.

- Option must be capable of exercise within 10 years.

- A written agreement is required.

- Option must be non-assignable.

Limit on options

The maximum value of EMI options that can be granted is £250,000 per employee. If an individual exceeds the limit, they will be blocked from further awards for 3 years from the time their holding falls below the limit.

The maximum value of EMI options that a company or group can grant is £3m.

For the purposes of these limits, the unrestricted market value of the shares must be used.

Disqualifying events

The beneficial tax reliefs can be lost if before the exercise of an option:

- the company ceases to carry on (or prepare to carry on) a qualifying trade

- the company is taken over by another company

- an employee no longer meets the working time requirements

- the employee ceases employment with the company or group

- a variation is made to the terms of the option which increases the market value of the shares under option, or makes it non-qualifying.

Tax relief can still be retained if exercise occurs within 90 days of a disqualifying event.

Administration

Share valuations may be agreed with HMRC in advance of the options being granted.

Valuations for EMI schemes are valid for 90 days from the date of the agreement.

The company must notify HMRC within 92 days of the end of the tax year in which the option was granted.

The company must also file an annual return online by 6 July following the end of the tax year.

Penalties may be charged if the return is filed late or is found to contain incorrect information.

Tax implications for the employer

The company may be entitled to a corporation tax deduction equal to the difference between the price paid for the shares and the relevant market value.

(It is important to remember this on a sale.)

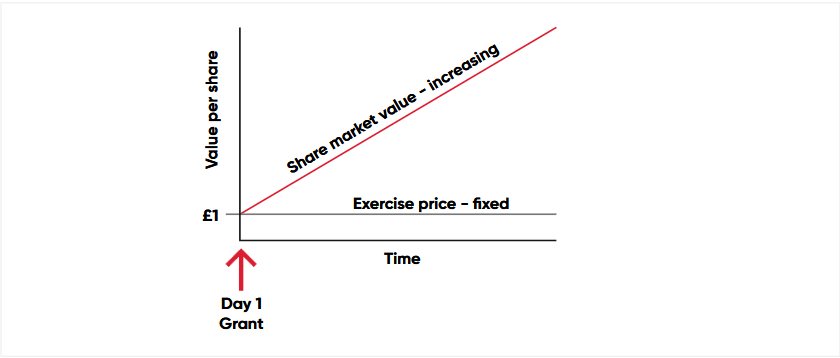

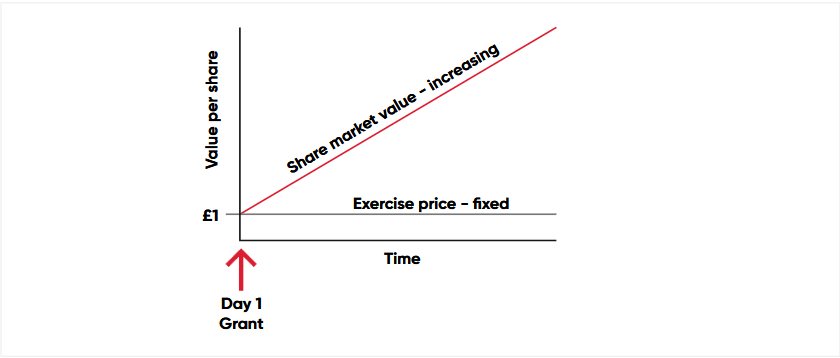

Grant – no tax to pay

No income tax or national insurance contributions (NIC) are payable on the grant of the option. The individual does not need to report the grant of the options on their tax return.

Tax Complications

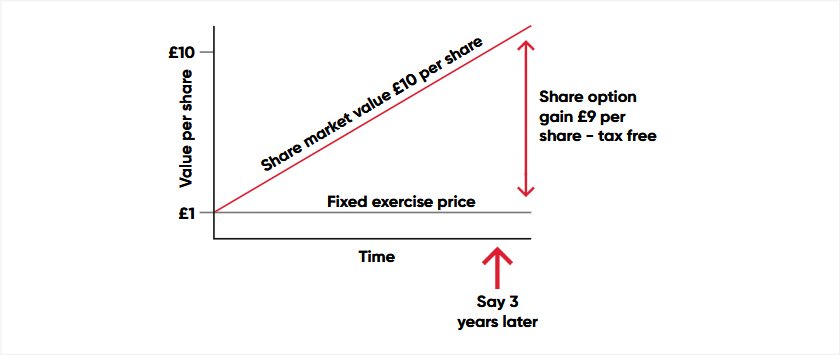

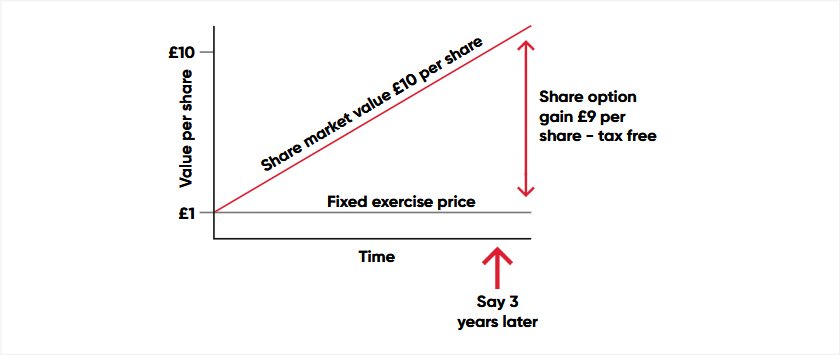

Exercise – no tax to pay

Provided that the options are exercised within 10 years of the date of grant, and if the price at which the employee can exercise the option is at least equal to the market value of the shares when the option was granted, no income tax or NIC

is charged.

The individual does not need to report the exercise of the options on their tax return in these circumstances

Exercise – no tax to pay

Provided that the options are exercised within 10 years of the date of grant, and if the price at which the employee can exercise the option is at least equal to the market value of the shares when the option was granted, no income tax or NIC

is charged.

The individual does not need to report the exercise of the options on their tax return in these circumstances

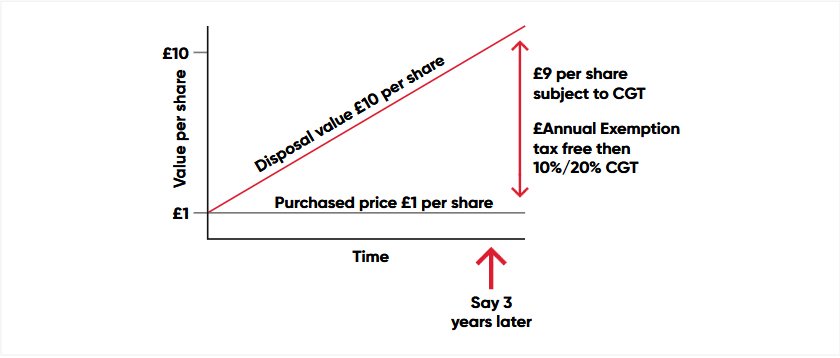

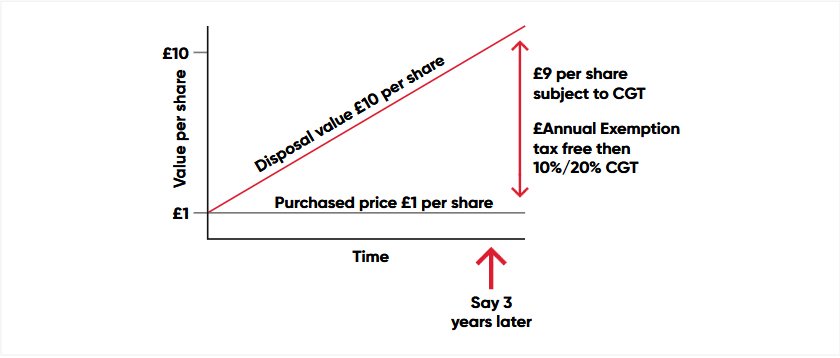

Disposal of Shares – CGT at 10%

On sale, a capital gain or loss will arise to the employee.

The difference between the exercise price of the EMI options and the sales proceeds received is subject to capital gains tax (CGT).

CGT is charged at 10% or 20%, depending on the rate at which the employee pays income tax. If the shareholding meets the qualifying conditions for business asset disposal relief, up to £1m (max) of the gain will be taxed at a rate of 10%.