Share schemes are a popular method of incentivising employees. The basic premise is the employee is rewarded for the growth in value of the company which they have themselves contributed to.

Overview of UK Share option Schemes

Do you need help with Overview of UK Share option Schemes?

We have the expertise to give you the advice that you need to make smart choices for the future.

Get in touch and see what we can do for you.

Incentivising Employees

The main choices for incentivising employees will usually be between:

- A cash bonus;

- A share award; or

- Share options

Cash Bonus

A cash bonus is self-explanatory, but it can also be linked to the share growth of the company through a ”phantom” share plan.

Share Award

A share award requires the drafting of potentially complex legal documents that create a binding contract between the parties. The shares to be acquired will have a monetary value that will often need to be determined by means of a valuation. This value is that at which either:

- The shares will need to be acquired by the employee; or

- The employee will pay income tax and possibly national insurance on.

Share Options

Share options provide a good halfway house between cash bonuses and share awards and are a great way to provide incentives without diluting the equity interest. The option arrangements will also need legal drafting and the value of the options to be acquired will need to be determined by means of a valuation.

Share option schemes can be tax-advantaged or non tax-advantaged. Tax-advantaged plans confer tax benefits on the shares/options issued. As is to be expected, the terms and criteria for tax advantaged qualification are specifically defined by HMRC. Any share scheme drafted outside of HMRC’s rules is a ‘non tax-advantaged’ scheme.

Tax-Advantaged Schemes

The current tax-advantaged plans are:

- Enterprise Management Incentive (EMI);

- Company Share Option Plan (CSOP);

- Share Incentive Plans (SIP);

- Save As You Earn (SAYE).

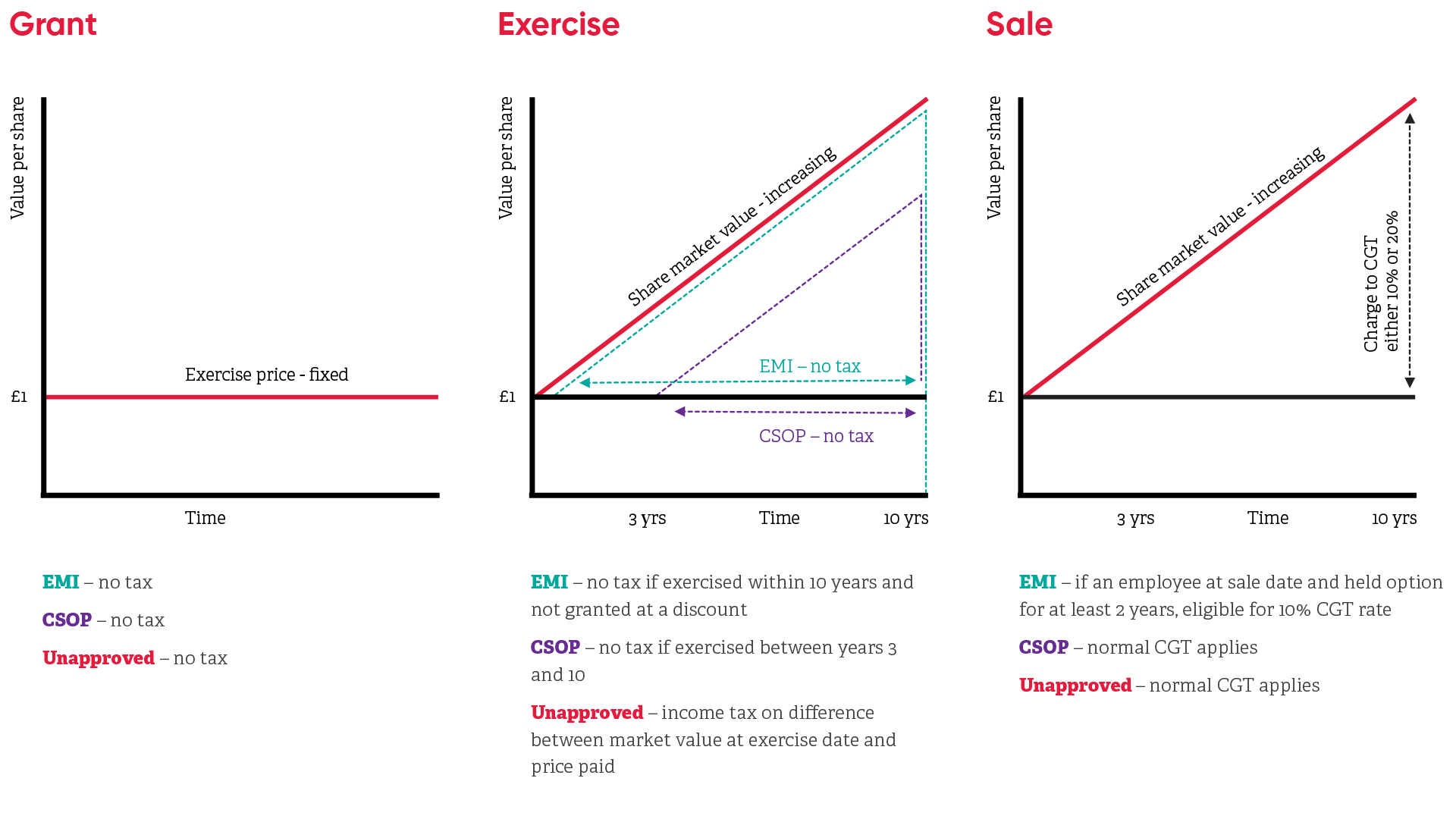

Where the criteria can be met, EMI is currently the most tax beneficial option scheme in the UK. We most commonly deal with EMI and CSOP schemes.

Non Tax-Advantaged Schemes

Where plans do not fall into one of the above tax-advantaged schemes, they will either be:

- Non tax-advantaged share options, or

- Non tax-advantaged shares / securities.

There will usually be an employment connection linking the awards made and tax rules in relation to, what are known as, “employment-related securities” will need to be considered.

At the end of this guide is a summary of the position at grant, exercise and sale for EMI, CSOP and unapproved options.

Reporting

As an employer, there are strict reporting requirements that will need

to be adhered to for all kinds of share schemes.

Where a company grants share options to its employees without using one

of the tax advantaged schemes listed above, the employees will be subject

to Income Tax when they exercise the option. This exercise will usually need

to be reported by the employees in their self-assessment tax return.

Where, however, a share (or other qualifying asset) acquired by the employee

is what is known as a “readily convertible asset”, both Income Tax and National Insurance contributions are due on the money’s worth of the shares; and these amounts must be collected by the employer through the payroll.

There are also a number of Income tax and National Insurance elections that will need to be considered.

Growth Shares

Growth shares are a special class of shares created so as to provide equity incentives to management and key employees. Members are rewarded for the growth in value of the company above a specified threshold. Growth shares can be used both as a tax-efficient alternative to options or, in certain circumstances, as part of a share option scheme.

While share and option schemes are great for incentivising employees, please note that this is a specialist area that requires specialist advice. Oury Clark would be happy to assist and advise you in this process. If this is an area which you would like to receive further information, please contact us to arrange

a meeting.

Summary of the position at grant, exercise and sale for EMI, CSOP

and unapproved options.

Related Quick Guides

Let us Introduce Ourselves

To find your nearest office or get in touch with one of our specialist advisors to see how we can help your business, please go to our contact page.