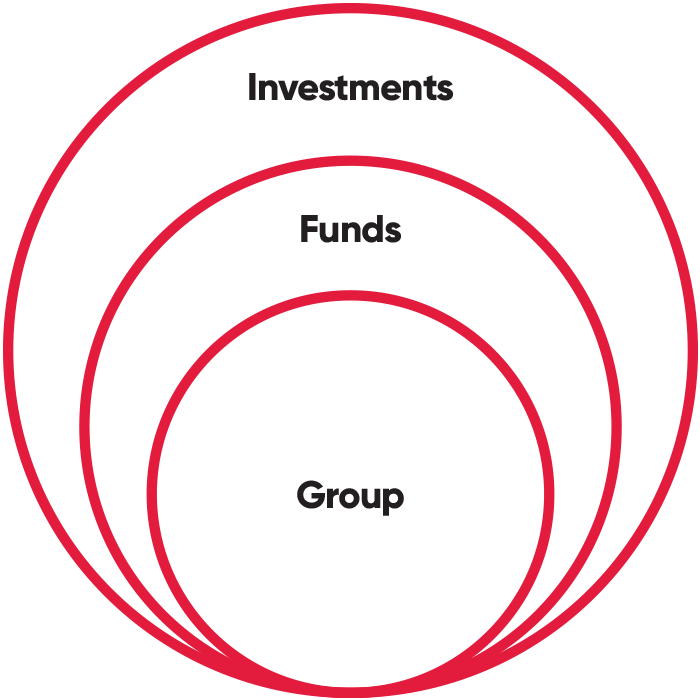

We establish a line of sight between your sustainability KPIs at an investment level up to the Fund and Group level as part of your fiduciary duty.

Slough Office: Herschel House,

58 Herschel Street, Slough SL1 1PG

London Office: 10 John Street,

London WC1N 2EB

Slough Office: Herschel House,

58 Herschel Street, Slough SL1 1PG

London Office: 10 John Street,

London WC1N 2EB

We advise private equity and investors on embedding sustainability and ESG into the investment decision-making. Decreasing investment risk and warding off potential litigation, to create value and use sustainability as differentiator for fundraising.

Responsible investing can drive value to all stakeholders and is part of business-as-usual to meet fiduciary duties.

Maximising your investment returns, helping to navigate your M&A strategy, and creating sustainable finance products to facilitate responsible investments, prioritising material environmental and social responsibility.

We establish a line of sight between your sustainability KPIs at an investment level up to the Fund and Group level as part of your fiduciary duty.

Private Equity firms face a set of strategic imperatives necessitating the integration of sustainability. We have observed that a robust sustainability agenda enables:

Risk Valuation

Legal, Compliance and Disclosures

Investor Confidence

Reputation and Cost Reduction

Premium Valuation

ESG Financial Value

Focusing on material business-specific ESG KPIs transparently linked to financial performance to achieve asymmetric upsides.

Regulatory Burden for SMEs

Our Governance and compliance-led approach means we support all businesses with new and evolving regulations, providing bespoke and detailed support to cut through the red-tape and achieve buy-in.

Climate change risks & opportunities

Our TCFD-aligned approach means we assess investments up to 15 years ahead to future proof and capitalise on value-creation for both physical and transitional climate scenario analysis for fan of outcomes.

Evolving ESG Landscape – Future-Proof

We tailor our approach to sector-specific drivers to ensure businesses are advantageously commercially positioned relative to their market as regulations and drivers change, for example generative AI.

Data gaps

Streamlined and material ESG metric reporting to meet LP requirements, with quick-guides and support to embed data governance.

ESG performance

Our approach ensures relevant and material ESG improvement through incentivisation and/or toolkits to drive improvement and evidences to LPs the positive impact made across ESG, e.g. H&S accidents down.

Capability and Capacity of company

Our ESG support empowers and upskills business owners, allowing them to focus on the business growth.

How Oury Clark can help you with your responsible investing process

Our approach focuses on identifying business drivers, assessing material ESG metrics (financial and where relevant impact), with a customer focused lens.

We work with you and the portfolio company to determine the most material metrics that business decisions should be made on, to maximise impact from both a sustainability and financial growth perspective.

We will tailor the approach below to enhance your requirements and drive value…

![]()

Define ESG Metric Set

![]()

Stakeholder Survey for Material ESG Metrics

![]()

Market Landscape – Customer & Competitor

![]()

Identify ESG Metrics to Drive ESG Performance

![]()

Prioritise, Roadmap & Implementation

To find your nearest office or get in touch with one of our specialist advisors to see how we can help your business, please go to our contact page.